BOQ Annual Reporting 2021

Annual Report

BOQ's 2021 Annual Report includes an overview of BOQ’s purpose and values, strategy, operations, the Group's audited financial statements and other statutory disclosures.

Sustainability Report

BOQ's 2021 Sustainability Report outlines our performance against social, environmental and economic opportunities and challenges.

Corporate Governance Statement

BOQ's 2021 Corporate Governance Statement discloses how we have complied with the ASX Corporate Governance Council's Principles and Recommendations.

FY21 Investor Materials

BOQ's FY21 Investor Materials provide a high level overview of the Group's performance along with a detailed result analysis and a discussion on the outlook, which covers the macro environment and the Group's high level priorities.

Dear Fellow Shareholders

I am delighted to be able to report a strong financial and operating performance for BOQ in FY21.

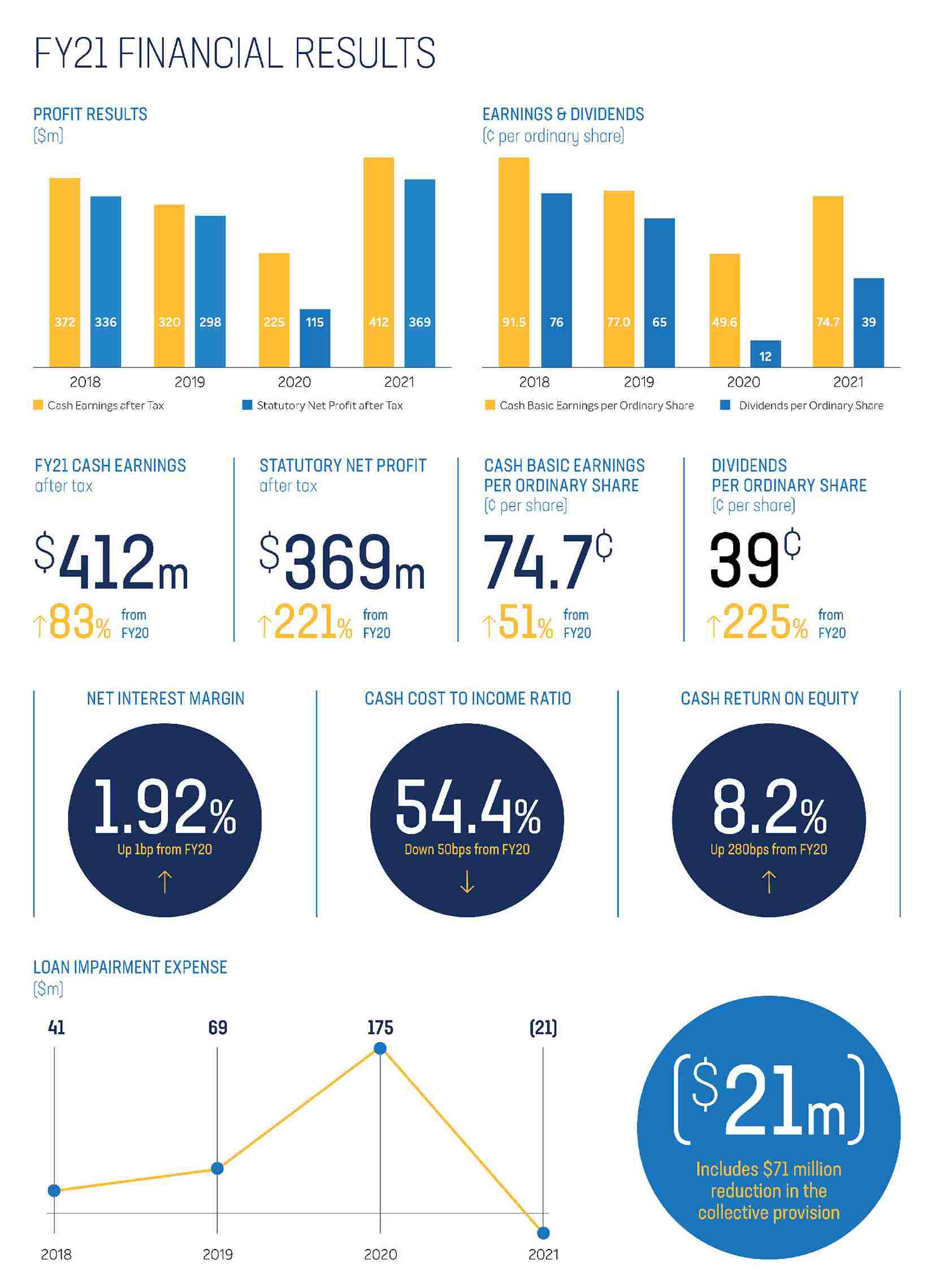

BOQ has delivered both statutory and cash earnings growth of 221 per cent and 83 per cent respectively. We have achieved statutory net profit after tax of $369 million and cash earnings after tax of $412 million.

Key highlights of our transformation progress this year include our strong financial results, achieving above system mortgage growth whilst maintaining prudent risk settings, strengthening our team with improved leadership and execution capability, further embedding our values driven performance culture, improving loan approval times for our customers, delivering phase 1 of our digital first strategy and the successful acquisition of Members Equity Bank Limited (ME Bank or ME).

The value accretive acquisition of ME Bank is strategically aligned, and is expected to deliver material scale and synergies, a diversified customer footprint, and rebalanced revenue channels with improved return on equity. The ME Bank integration is on track and is a key strategic deliverable over the next 12 months.

We are making material progress in delivering our growth strategy to uplift our financial and customer performance and build a scalable multi-brand digital-first bold challenger bank with a personal touch.

These pleasing results underscore our continuous improvement journey and high ambition to delight our customers, be a great place to work and to grow shareholder value.

Customers

Continuing to improve the customer experience and delight our customers every day is at the heart of our strategic transformation.

During FY21 we enhanced the digital bank proposition for Virgin Money Australia customers by offering transaction and saving account services for the first time. This was built on a digital platform that we will extend to form the foundation for the Retail Bank, delivering improved digital customer offerings and experiences for all the BOQ Group brands.

We will continue to work closely with our customers, the government and regulators, to ensure we maintain support for customers facing hardship or requiring help resulting from the COVID-19 pandemic.

Shareholders & Capital Management

The transformative acquisition of ME Bank and our improved performance this financial year have enhanced shareholder value.

We recognise the importance of dividends to our shareholders and the Board has determined to pay a final fully franked dividend of 22 cents per share, bringing the FY21 dividend to 39 cents per share. Barring unforeseen circumstances, we are targeting a dividend payout ratio between 60 per cent and 75 per cent of cash earnings going forward. We believe this payout ratio enables BOQ to balance an attractive annual distribution to shareholders against the capital needed to support our business transformation, growth and the resilience of the bank.

We remain committed to prudent balance sheet and capital management. Our CET1 ratio at financial year end was 9.80 per cent. During this higher risk period we intend to retain our CET1 ratio above the top end of our target range of 9.0 - 9.5 per cent1.

We funded the ME Bank acquisition via a $1.35 billion capital raising, and we thank shareholders for their support. Due to unforeseen extensive delays in Australia Post some of our retail shareholders missed the cut-off date for acceptance of the rights issue offer. We sincerely apologise to those shareholders that were unable to participate.

The capital raising timeline and structure was determined based on the material size of the capital raising as a per cent of our market capitalisation and the need to present an attractive fully underwritten bid to provide certainty of funding and price in a competitive tender process. We believe the accelerated timeline and non-renounceable structure were critical to BOQ Group achieving a timely underwritten capital raising, winning the bid, minimising the dilution impact of the capital raising and providing the opportunity to create value for all of our shareholders.

People & Culture

Embedding a performance driven culture through empowering our people and holding them to account to deliver against our key performance indicators is core to our strategic transformation. We are encouraging our people to speak up, question the status quo and experiment to achieve improved outcomes.

Reliability, transparency and trust are at the core of everything we do. Living our purpose and values drive excellent conduct and better customer and community outcomes.

Keeping our people safe and informed and maintaining continuity of our operations have been key priorities during the pandemic. We have adopted an agile approach to working that includes a hybrid model of returning to the office when health directions permit, along with remote flexible working. Our branches remained open throughout the various pandemic restrictions and we are proud of the dedication shown by our people who continue to attend our workplaces to support our customers.

We recognise that quality people and strong leadership will drive our success. We continue to enhance and develop the calibre of the leadership team and our people, building a diverse team with strong execution capability.

Building a sustainable business

BOQ remains committed to building a sustainable business and recognises our social responsibility to deliver improved outcomes for all stakeholders and the environment. We continue our journey to being a more sustainable organisation by achieving carbon neutral certification during FY21.

Board renewal

The BOQ Board embarked on a period of renewal and continuous improvement in late 2019 to enhance our diversity, future fit skills mix and intellectual curiosity. Effective from the 2021 AGM the Board renewal program will be complete. The size of the Board will have reduced from 11 to 8 Directors (7 non-executive).

I welcome Mickie Rosen and Deborah Kiers who joined the Board in 2021 and look forward to the considerable contribution they will bring across their combined skills of digital transformation, consumer experiences, organisational design, people & culture, strategy and ME Bank Heritage.

I would like to take this opportunity to thank Kathleen Bailey-Lord, who retired from the Board in 2021 for her contribution to BOQ.

Looking ahead

Under the strong leadership of George Frazis, our Managing Director & CEO, and the Executive Committee we have good momentum in the business and are well positioned to continue to progress our transformation journey. We are 18 months into this journey and have a lot more to do to meet our ambitious aspirations for BOQ to create long term value for our customers, shareholders and our people.

Our operating environment remains uncertain with the ongoing pandemic, high asset prices and increased leverage at a low point in the interest rate cycle. We will continue to support our customers with flexible policies and relief packages, manage prudent risk settings in this higher risk environment and refine our strategy where appropriate.

With the increased vaccine rollout across Australia we are cautiously optimistic about the future. We encourage all of our stakeholders to get vaccinated to support their wellbeing and the lifting of lockdown restrictions enabling the re-opening of Australia.

I express my deepest thanks to my colleagues on the Board, our CEO, the Executive Committee and all our employees for their material contribution to BOQ.

Thank you to our customers and shareholders for your ongoing support of BOQ.

Patrick Allaway

Chairman

1BOQ intends to operate above the management target range of 9.0 - 9.5 per cent in FY22 until the final impacts of APRA’s changes to RWAs and capital calibration are understood. Refer to page 54 in the ME Bank acquisition investor presentation for further detail.

Dear Shareholder

This year we have seen economic conditions improve compared to the previous year due to the commencement of the vaccine rollout and related consumer and business optimism. However, recent lockdowns and restrictions have reminded us that COVID-19 and the associated economic consequences remain present. I believe the saying is “tough times don’t last, tough people do,” and that has never been more true of our people and our customers who have shown resilience and optimism despite the challenges.

As stewards of a business with a long heritage, my team and I have continued to focus on delivering our strategy to enhance the experience for our customers, stakeholders and people.

Customers and Community

BOQ’s strong balance sheet and the commitment of our people allows us to support customers in hardship as well as contribute to meaningful community initiatives. In the past 12 months BOQ supported hundreds of customers in hardship with personal and business loan deferrals and in August we simplified our systems and removed dishonour fees for overdrawn accounts. We have maintained our retail and business Net Promoter Score ranking of 3rd during FY21 by delivering a superior customer experience.

We recognise the role BOQ plays in the communities in which it operates. We continued our support of Aboriginal and Torres Strait Islander peoples through our work with the STARS and Clontarf Foundations that provide education and development of life skills for these communities. We also continued our relationship with our community partner Orange Sky during the year to provide laundry and shower vans for people in need.

Progress against strategy

Our experienced executive team continues to deliver against the strategy outlined to the market in February 2020. The ME Bank acquisition underscores our growth agenda by significantly expanding our Retail bank and allowing the Group to diversify its revenue profile and geographic presence.

Significant progress has been made against the transformation roadmap with a key achievement being the launch of savings and transactions accounts for Virgin Money, entrenching its credentials as a digital bank. Another important step on our digital roadmap was the upgrade and integration of our card management system. This has allowed us to put both BOQ and VMA cards on the same platform which enables improved digital banking app capability. This has also delivered the choice and convenience customers have been requesting as the new digital wallet capability now allows them to link their cards to Apple Pay, Samsung Pay and Google Pay.

The second phase of the Virgin Money Digital bank to include home loans and additional deposit products is well progressed, and the scalability of the API based digital platform allows this technology to be leveraged as a strategic Group platform, with the build of a BOQ Digital Bank substantially underway.

The multi-year roadmap incorporates the ME Bank integration to ultimately deliver a common, cloud based Retail platform for all BOQ brands.

Work continues on enhancing our lending process from front to back, with the Small Business Enablement program underway identifying efficiencies. Other key investment includes the build of the Intelligent Data Platform foundations to enable Open Banking capabilities, and a program to enhance the user experience for our people.

We have delivered a further $30 million in productivity savings across the Bank in FY21 in addition to the $30 million delivered in FY20. These savings have enabled us to invest in new digital, risk and regulatory programs.

The sale of St Andrew’s is expected to be completed in 1H22, enabling BOQ to simplify its business model and focus on niche customer segments.

People

The Executive Team and I are united in our commitment to making BOQ Group a great place to work and pleasingly, our engagement score increased five per cent in FY21 compared to last year’s score.

We have built a strong leadership team with the addition of Martine Jager as our Group Executive Retail Banking and CEO ME Bank, Danielle Keighery as the Chief Customer Officer and Nicholas Allton in the role of Group General Counsel and Company Secretary. We have recently announced the appointment of Chris Screen to the role of Group Executive Business Banking and we will welcome David Watts as BOQ’s Group Chief Risk Officer in early 2022.

During the year we welcomed a large number of new employees to the Group through the acquisition of ME Bank. This team enhances our presence in Victoria and we believe our aligned customer-focused cultures will see a successful integration of ME Bank into the BOQ Group while continuing to maintain a differentiated proposition through the ME brand.

We continued to focus on the wellbeing of our people during the year and to manage for impacts from COVID-19 we implemented flexible policies for non-front line workers and ensured eligible employees could take advantage of special leave for vaccinations. I am proud of our people and the key role they continue to play in supporting customers. I thank them for their dedication and acknowledge their hard work over the course of another trying year.

Performance

The execution of our strategy throughout FY21 has driven our strong business performance for the year.

Total income increased by 13 per cent as we continued to grow our balance sheet above system while preserving our margins. Our expenses grew 12 per cent during the year as we supported volume growth, while investing for the future.

Impairment expenses decreased during FY21 as we reduced the collective provision in light of changes to the economic environment and expected future loan losses. Maintaining a strong balance sheet continues to be important for BOQ, and our capital remains comfortably above APRA’s benchmark, with a CET1 ratio of 9.80 per cent.

Overall our improvement in statutory NPAT of 221 per cent to $369 million, reflects the improved business performance, operating conditions and a customer focused culture.

Having completed the acquisition of ME Bank on 1 July 2021, our integration program has shown solid progress with early momentum and focus resulting in the acceleration of synergies and the development of a clear integration roadmap.

The future

Even as our future feels uncertain because of the ongoing impact from the pandemic, I’ve never felt more optimistic about the ability of our people and customers to pull through to better times. As the vaccine rollout gathers pace and policy settings encourage economic stability and growth, I’m hopeful our customers, stakeholders and people will join our business in returning to a more stable operating environment.

Looking ahead, I am very excited about the future. The integration of ME Bank is underway and we have a clear strategic roadmap which we are executing against. We are committed to repaying the support of our shareholders by delivering sustainable profitable returns.

I believe we have the right people in place to execute on our strategy to transform BOQ into a digital bank with a personal touch to create a compelling proposition for our shareholders, customers, people and the community.

George Frazis

Managing Director and CEO