BOQ Annual Reporting 2020

Annual Report

BOQ's 2020 Annual Report includes an overview of BOQ’s purpose and values, strategy, operations, the Group's audited financial statements and other statutory disclosures.

Sustainability Report

BOQ's 2020 Sustainability Report outlines our performance agaist social, environmental and economic opportunities and challenges.

Corporate Governance Statement

BOQ's 2020 Corporate Governance Statement discloses how we have complied with the ASX Corporate Governance Council's Principles and Recommendations.

FY20 Investor Materials

BOQ's FY20 Investor Materials provide a high level overview of the Group's performance along with a detailed result analysis and a discussion on the outlook, which covers the macro environment and the Group's high level priorities.

BOQ Customer Story

All Purpose Coatings (APC)

See our excellent customer service come to life through this one minute video about the APC team (valued BOQ customers since 2012) and John Lynch (Owner-Manager, BOQ Middle Park).

Dear Shareholder

Last year we committed to achieving better outcomes for our stakeholders. We recognised the need to take decisive action to improve performance and outlined five key priorities to return BOQ to profitable and sustainable growth. We foreshadowed that the transformation will take time with a difficult year ahead in FY20.

The past 12 months have been a more challenging period than we could ever have anticipated, with the impact of the devastating bush fires and the COVID-19 health pandemic, causing considerable hardship for our customers, shareholders, employees and the communities in which we operate.

Our highest priority through this period has been to ensure we live our purpose of creating prosperity for our customers, shareholders and people through empathy, integrity, and by making a difference.

Performance

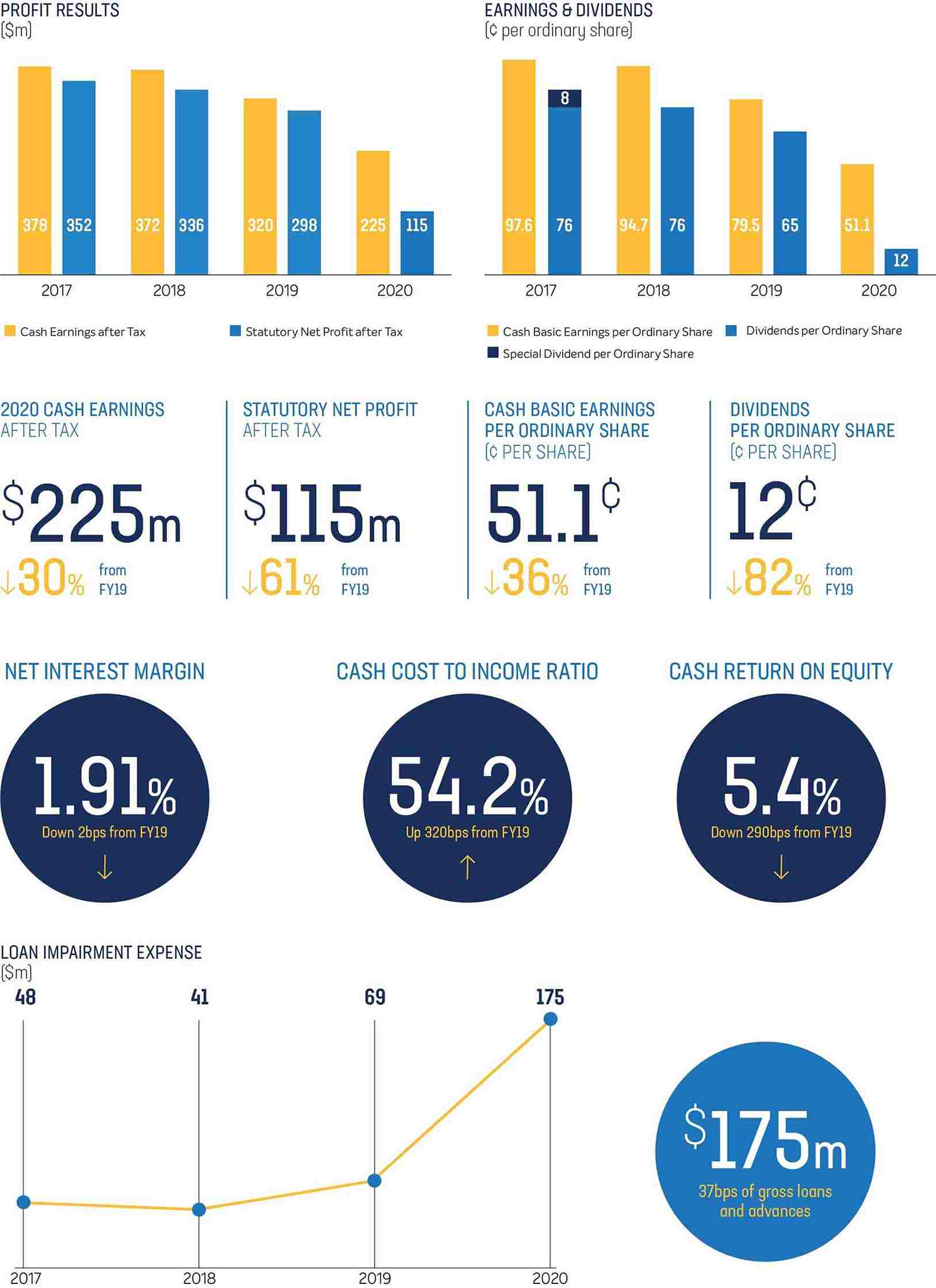

Our financial performance of statutory net profit after tax of $115 million, cash earnings after tax of $225 million and the dividend of 12 cents reflect the difficult external operating environment and a year of transition. We have taken a material provision for expected credit losses resulting from the impact of the COVID-19 pandemic on our customers and a write down in our technology investment reflecting changes in our digital strategy to achieve better outcomes for our customers. While not yet reflected in our financials, we have made good progress this year in executing our transformation plan to return BOQ to profitable growth and growing long term shareholder value.

Customers

BOQ has played an important role in supporting our customers in bridging this severe economic downturn. Working closely with government, regulators, and others in the sector; we responded quickly to provide solutions for customers in hardship with financial relief for households and small businesses. We remain focused on improving our customer performance and have elevated the customer voice within BOQ.

We have improved our ranking from 5th position to 3rd on customer net promotor scores and were named 2020 MOZO People's Choice Award winner in the excellent customer service category. We have more to do to delight our customers and achieve our objective of being a leading digital bank of the future with a personal touch.

Shareholders

We recognise this has been a difficult year for you, our shareholders, with loss of shareholder value and a reduction in dividends, which we understand many of you rely on to support your income. Prudent balance sheet and capital management has been critical to ensure our support for your long term shareholder interests.

Following the capital raising in December last year we are well capitalised to fund our transformation and trade through the current credit cycle. Our intent to pay dividends remains unchanged. The future payout ratio will reflect APRA guidelines and be balanced against the ongoing assessment of the resilience of the Bank to absorb credit losses, the protection of deposit holders and debt security holders and the investment in our transformation to grow long term shareholder value.

Employees

Through the pandemic we have focused on ensuring the safety and well-being of our employees, while maintaining continuity of our operations. Our people have performed strongly over the past twelve months, executing against our strategic priorities, adapting to new ways of working whilst retaining productivity and dedicated support for our customers. We have moved with agility and our purpose led culture has driven the right behaviours. Recognising both the improved performance of our people and the difficult year experienced by shareholders, the Board has exercised its discretion to moderate the short term incentive (STI) compensation payment for 2020. Further, we have resolved to make no cash STI cash payments to senior executives this year with the award being paid in deferred equity to better align with our shareholders.

Strategy

We announced our updated strategy to the market in February this year with a transformation plan to materially improve our performance. We have five strategic priorities with the ambition to be known as the bold challenger bank with multi-brands that are digitally enabled with a personal touch. We are pleased with the progress that has been made during the year against these priorities, in particular on our digital transformation journey, while maintaining a strong financial and risk position which has been critical throughout the current pandemic.

Leadership

We recognise that quality people and strong leadership will drive our success. George Frazis commenced in his role as Managing Director & CEO in September 2019 and has already made a material difference to BOQ, bringing a performance driven approach while navigating the uncertainty of the COVID-19 economic impacts. Supporting George to strengthen the capability of BOQ's Executive and senior leadership team has been a key priority for the Board. We were pleased to welcome Ewen Stafford as our Chief Financial Officer and Chief Operating Officer, Fiamma Morton as Group Executive BOQ Business and Craig Ryman as Chief Information Officer. In FY21 Danielle Keighery will join BOQ as the Chief Customer Officer. We have materially increased the depth of talent and experience in the leadership team and believe that under the strong leadership of George we have the right skills and experience to deliver BOQ's transformation agenda.

Culture and Governance

Culture and governance remain key priorities for the Board and BOQ. During the year we conducted a cultural review and in response, embarked on a cultural transformation. At its core, is our shared commitment to our purpose and values of empathy, integrity and making a difference. We are shifting the organisation to a performance led culture with executive empowerment and accountability to deliver our plans. Our future remuneration framework has been updated to further align leadership performance with long term shareholder value creation, reduced cash payments, attracting and retaining talent and ensuring appropriate risk behaviours. We are committed to continuous improvement and excellence in corporate governance, increasing transparency in our reporting, compliance with our regulatory obligations, and protecting our license to operate.

Building a sustainable business

BOQ is committed to building a sustainable business for our stakeholders. We have a responsibility to invest and manage our business to deliver strong returns for our shareholders at the same time as improving outcomes for the community and environment. BOQ recognises the role it can play in reducing its own carbon footprint and supporting our customers on their sustainability journey.

Board renewal

Following my appointment as Chairman in October 2019, BOQ conducted a Board performance and skills matrix review. Facilitated by an independent third party, the review focused on improving the effectiveness, and performance of the Board. Since the review, the number of non-executive directors has been reduced from ten to seven, with the Board succession plan committed to improving diversity of thought, digital transformation and strategic capability. Non-negotiable attributes to strengthen the Board's dynamic include emotional intelligence, respect, constructive challenge, listening, openness to alternate views and intellectual curiosity. We implemented a Board code of conduct, restructured committees with attendance from all Directors and implemented a three term guideline for Directors. I would like to take this opportunity to thank Richard Haire and Michelle Tredenick, who retire from the Board in 2020, for their contribution to BOQ.

Looking ahead

The Board and I recognise that 2020 has been a particularly challenging year. We wish to thank you for your ongoing support of BOQ and look forward to delivering improved experiences and outcomes.

The evolving magnitude of COVID-19 is creating considerable economic dislocation, a highly uncertain operating environment and shifts in consumer behaviours, public expectations and operating models. We will continue to refine our strategy to reflect these shifts and deliver long term sustainable outcomes for our people, customers, communities and shareholders.

In keeping with our focus on health and safety, this year our AGM will be held online on Tuesday 8 December 2020 rather than at a physical location. Shareholders will have the ability to participate remotely via an online platform or by lodging their proxy, vote, or questions in advance of the AGM.

We appreciate the considerable responsibility of the Board and management to deliver better outcomes for all our stakeholders and we remain committed to doing so.

Patrick Allaway

Chairman

"Our highest priority through this period has been to ensure we live our purpose of creating prosperity for our customers, shareholders and people through empathy, integrity, and by making a difference."

Dear Shareholder

It has been a year like no other. Bushfires, storms, coronavirus disease (COVID-19) and the associated economic consequences have required the very best from our people and they have delivered. No matter the challenge, we have responded with empathy and agility, doing everything we can to best look after our customers.

While all of this was going on, we have also been getting on with making your Bank, a better bank.

Customers and Community

BOQ's strong balance sheet, combined with the commitment of our people, has enabled us to support our customers through the financial impacts of the crisis, providing much needed cash flow. We have processed more than 21,000 personal and business loan deferrals, extended credit, and implemented a number of short term fee waivers and product changes.

We recognise the role we play in the broader community. In addition to providing fast track financial relief to customers impacted by bushfires, drought, and floods, we donated $150,000 to our community partner Orange Sky, which mobilised laundry and shower vans to bushfire affected areas.

Progress against strategy

In February 2020, we set out BOQ's refreshed strategy to make BOQ a better bank. We have five strategic priorities: our empathetic culture sets us apart; we are focused on distinctive brands serving profitable niche customer segments; we are a digital bank of the future with a personal touch; a simple and intuitive business, with strong execution capability; and we have a strong financial and risk position, with attractive returns.

Our refreshed and strengthened executive team are getting on with it. I am very pleased with the progress we have made in the last 12 months, particularly since we updated the market in February.

Our digital transformation is key to our progress. We have delivered the modernisation of our data centres to the cloud and the first phase of the VMA digital bank is due to be completed by the end of the calendar year.

We have also made material changes to our home lending process, significantly reducing the ‘time to yes' for our customers from over four days down to one day.

We have delivered around $30 million in productivity savings across the Bank and have reduced our FTEs by c.3 per cent. These savings have enabled us to invest in new digital and risk and regulatory programs.

We are helping our people to deliver a superior customer experience. The changes we are making has seen us lift our Net Promoter Score (NPS) ranking from 5th in FY19 to 3rd in FY20, and our Mortgage NPS ranking improved from 11th in FY19 to 5th in FY20.

The announced sale of St Andrew's represents an important strategic milestone for BOQ. The divestment enables us to focus on our niche customer segments while simplifying our business model.

People

As we responded to COVID-19, our internal focus was on ensuring our people could work safely and in new ways. Despite the challenging environment, the focus on empathy throughout the business saw employee engagement increase by 3 per cent during the year. We want to keep improving our employee engagement.

I am proud of our people, the support they have provided to each other, and the resilience they have demonstrated in meeting the needs of our customers. I thank them for their commitment and want to acknowledge their hard work over the course of the year.

Performance

Like many organisations, our FY20 financial performance has been impacted by both COVID-19 and by a number of strategic foundational investments. Total income increased by 1 per cent as we continued to grow our balance sheet while preserving our margins. Our expenses grew 7% during the year as we invested in risk and regulatory enhancements and key strategic investments. Impairment expense increased materially due to the additional

$133 million collective provision overlay taken for estimated future loan losses related to the pandemic. These impacts resulted in a 30 per cent reduction in cash net profit after tax for FY20.

Maintaining a strong balance sheet has been important for BOQ throughout the pandemic as it has enabled us to support our customers and in turn contribute to the resilience of the broader economy. During the year we have increased our level of customer deposits by 7 per cent which has further strengthened our liquidity position, and our capital remains strong with a CET1 ratio of 9.78 per cent, comfortably above APRA's unquestionably strong benchmark.

Pay and entitlements review

During the year BOQ commenced a pro-active review of historical employee pay and entitlements, which identified potential issues relating to superannuation, pay, and entitlements. I have made a full and unreserved apology to people affected by these issues and we are focused on ensuring these people are remediated fully as a matter of priority.

We will get this right and we will make sure our people, past and present receive every cent they are owed.

The future

Looking ahead, the duration and ongoing impacts from the COVID-19 pandemic remain uncertain. We are committed to supporting our customers and people throughout this period and will work closely with those requiring additional support.

With a strong capital position, good levels of liquidity, prudent growth in our balance sheet, and provisions in place to cover impacts to the lending portfolio, BOQ is well positioned to navigate through this period.

I believe we have the right team in place to deliver on our strategy, transforming BOQ into to a digital bank with a personal touch, backed by a strong balance sheet, delivering value for our shareholders, customers, people, and community.

George Frazis,

Managing Director and CEO

"While FY20 has clearly been an extraordinary year, I am very pleased with the way BOQ has supported our customers and people and been able to make great progress in becoming a better bank.

We have the right team in place to deliver on our strategy, transforming BOQ in to a digital bank with a personal touch, backed by a strong balance sheet, delivering value for our shareholders, customers, people, and community."