BOQ Announces Items Impacting the FY20 Results

Tuesday, 29 September 2020

Bank of Queensland Limited (BOQ) today announced that it has completed its FY20 collective provision modelling and the FY20 loan impairment expense will be $175m (pre-tax). This includes a COVID-19 related collective provision expense of $133m (pre-tax) which is based on updated RBA economic data, analysis of customers on the banking relief package and their likelihood of recovery, and a significant exposure review.

Further, an expense of $11m (pre-tax) resulting from a pro-active review of historical employee pay and entitlements will be included in the FY20 result.

Loan impairment expense

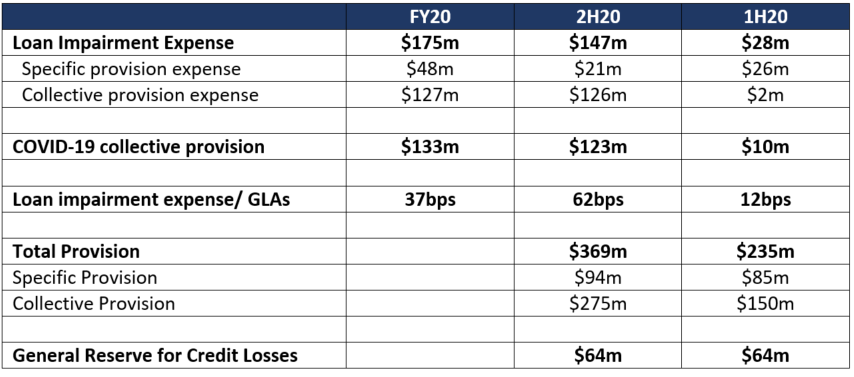

The FY20 impairment expense of $175m equates to approximately 37bps of gross loans. More detail on the loan impairment expense is included in Appendix 1.

The FY20 COVID-19 related collective provision totals $133m, comprising a $10m provision in 1H20 and a further $123m provision in 2H20. This is expected to reduce the CET1 ratio by 39 basis points (bps), with CET1 ending the year comfortably above the target range of 9.0% - 9.5% due to strong 2H20 organic capital generation which broadly offsets this reduction.

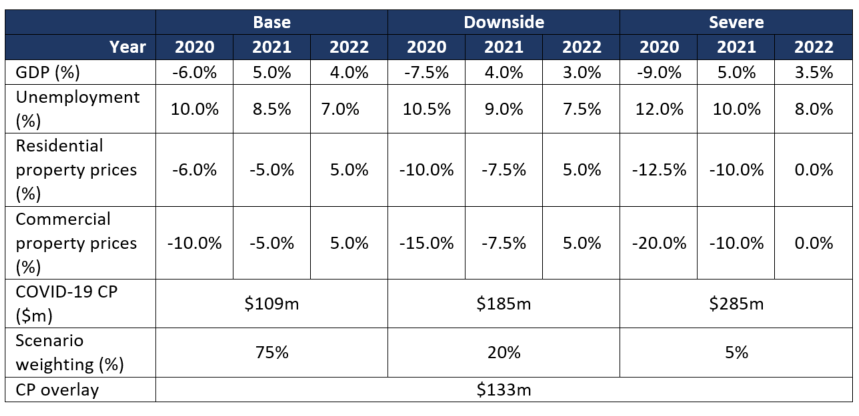

The increased provision is the result of updated economic forecasts since our first half reporting, utilising where possible the latest RBA data, and industry and sector impact assumptions as follows:

Higher unemployment

Downgrades to property prices

Increased duration of the economic downturn

We have also increased the probability weightings to the downside and severe case scenarios from those in our 1H20 modelling assumptions.

Details of the underlying economic assumptions are included in Appendix 2 and take into account the substantial government stimulus provided to protect jobs and businesses.

Managing Director and Chief Executive Officer George Frazis said: “The revised provision reflects the anticipated lifetime losses on the current portfolio relating to the impacts of COVID-19 in line with AASB 9 Financial Instruments”.

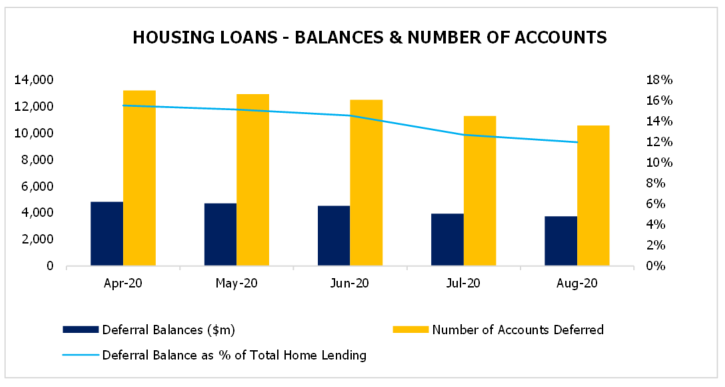

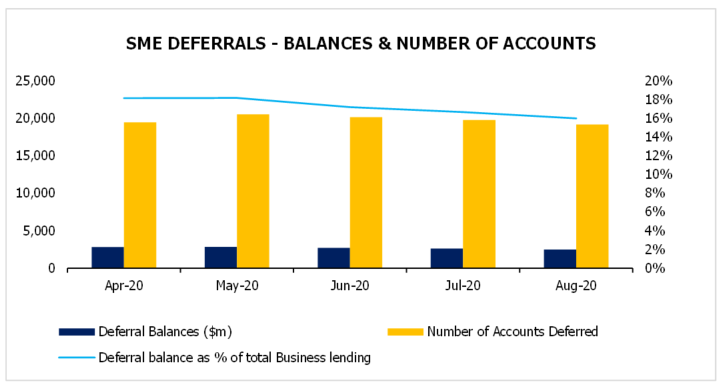

BOQ is committed to supporting customers during this difficult period through a range of relief measures and by ensuring a flow of new credit into the economy to help small and medium businesses get back on their feet. BOQ continues to see reductions in customers accessing financial assistance through the banking relief package. As at 31 August 2020, BOQ has 12% of housing customers on the banking relief package, and 16% of SME customers (based on gross loans and advances). Of those customers accessing the relief packages, 25% of customers are continuing to make full or partial repayments. Further information on BOQ’s banking relief packages is included in Appendix 3.

“As we all know, this has been an unprecedented year and BOQ is committed to supporting our customers throughout this period. We are very pleased to see many of our customers returning to work and re-opening their businesses and will continue to work closely with those that require further assistance”, George Frazis said.

Employee pay and entitlements review

Having witnessed remuneration and superannuation issues elsewhere, BOQ believed it was prudent to commence its own review of its employees’ pay and entitlements. That initial internal review identified some irregularities in superannuation payments and then subsequently identified potential issues relating to people employed under an Enterprise Agreement (EA) and specific requirements under the 2010, 2014 and 2018 EAs.

BOQ has made a full and unreserved apology to people affected by these issues and will ensure people are remediated fully as a matter of priority as it completes a broader external wage analysis and review for EA employees.

BOQ has already made superannuation payments to the Australian Taxation Office (ATO) as part of the Superannuation Guarantee Amnesty in the amount of $2.4m. BOQ and the ATO will contact any current or former employees receiving these superannuation payments in the coming months.

“We will get this right and we will make sure our people, past and present receive every cent they are owed. This is an absolute priority”, George Frazis said.

BOQ has advised the Fair Work Ombudsman and the Financial Services Union (FSU), and has engaged external third parties to assist with the analysis and remediation process. The impact of the errors remain under investigation with further work to be done to determine the full impact. An expense of $11m (which includes the $2.4m already paid and a provision of $8.6m) will be taken in the FY20 financial statements.

Dividend update

“We are very aware of the importance of dividends to our shareholders, including to our significant number of loyal retail shareholders. We have completed our scenario analysis in relation to dividends and have consulted with APRA in line with the guidance issued on 29 July 2020. The Board will make a determination on dividends in relation to FY20 at our full year results” George Frazis said.

BOQ’s FY20 results will be announced on 14 October 2020.

Appendix 1: Loan Impairment Expense Detail1

1 Note rounding differences occur between the sum of 1H20 and 2H20 and the total FY20 result.

Appendix 2: Collective Provision Assumptions

Economic assumptions

Appendix 3: Banking Relief Packages

Housing Deferral Balances and Accounts2

SME Deferral Balances and Accounts2

2 Number of deferred accounts and balances compared to gross loans and advances. Note this calculation varies to the APRA July 2020 loan repayment data statistics due to differences in definition.

ENDS