FY20 Results Announcement

Wednesday, 14 October 2020

FY20 has been a year like no other. Despite the headwinds, we have made good progress in delivering strategic initiatives to transform the bank and drive business momentum through revenue growth.

FY20 FINANCIAL RESULTS

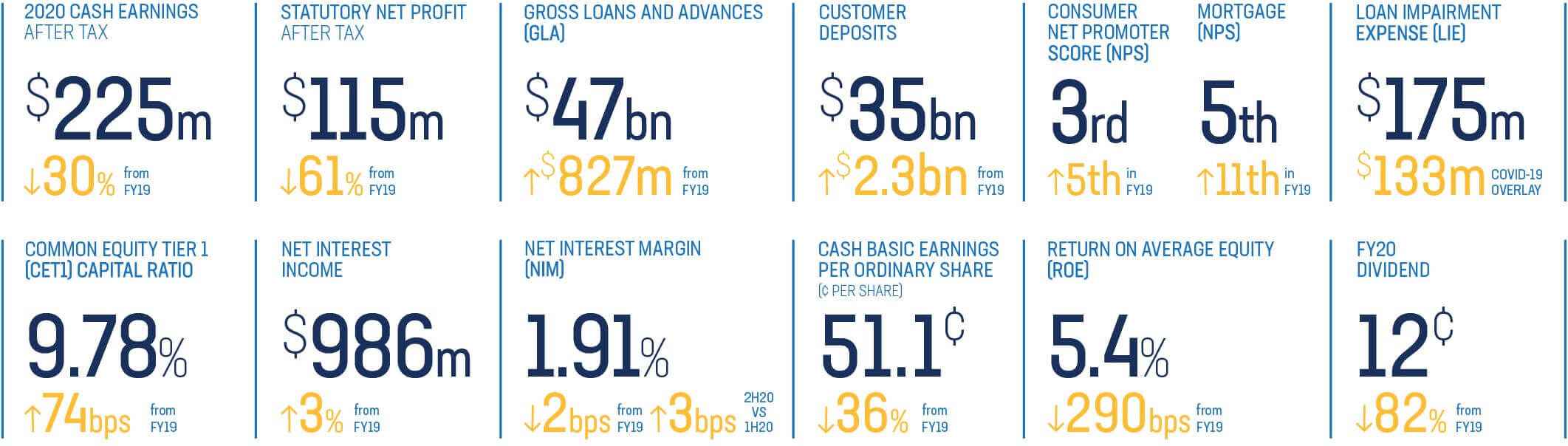

- Cash NPAT FY20 cash earnings after tax of $225m, down 30%

on FY19. This was largely the result of the $133m COVID-19

collective provision. - Statutory NPAT decreased by 61% to $115m due to the

previously guided restructuring charges and intangible asset

review. - Total income increased to $1,096m for the year, up 1% from

FY19, driven by lending growth of $827m and a focus on margin

management. - Net Interest Income increased to $986m for the year, up 3%

from FY19, driven by lending growth and NIM. - Net Interest Margin increased by 3 basis points (bps) in 2H20

which, combined with lending growth drove the 3% uplift in

revenue during the half. - Non-interest income decreased by 14% over the year, reflecting

industry trends towards low and fee free banking products, as

well as a c.$10m impact from COVID-19 related fee reductions,

waivers and lower income relating to the Velocity program. - Operating expenses increased by 7% to $594m in what

was a transitional year for BOQ. The key drivers were digital

transformation and $21m invested in risk and regulatory

programs. This expense growth was partly offset by $30m in

productivity savings.

- CET1 at 9.78%, well above APRA’s unquestionably strong benchmark. BOQ continues to have a strong balance sheet.

- FY20 Dividend: BOQ has determined to pay a full year dividend of 12 cents per share representing 6 cents per share from 1H20 profits and 6 cents per share from 2H20 profits.

- Loan impairment expenses increased to $175m. This increase was

primarily due to the $133m collective provision overlay in relation to the anticipated lifetime losses from COVID-19. - COVID-19 Banking Relief: Of the 21,000 customers who accessed banking relief, 25% continued to make full or partial repayments. Since the peak in April, we have seen a reduction in the total loan balances on deferral by 18.8%. As at 31 August 2020, BOQ has 12% of housing customers and 16% of SME customers (based on GLA) remaining on banking relief.

- Lending growth momentum increased across both the housing and business lending portfolios during FY20. Housing growth lifted to be broadly in line with system, while business lending grew by 3% as system growth contracted.

- Customer deposit growth of $2.3bn over the year assisted by elevated liquidity arising from government stimulus. Deposit to loan ratio of 74% up from 69% in FY19.

- Consumer and mortgage NPS increased to 3rd and 5th respectively, up from the FY19 ranking of 5th and 11th as a result of improvements to our customer experience and enhanced mortgage processes.

FY20 RESULT OVERVIEW

Managing Director and CEO George Frazis: BOQ’s FY20 result reflects the challenging environment and a year of transition. Our FY20 financial performance has been impacted by both COVID-19 and by a number of strategic foundational investments. Business momentum continued with revenues growing 1% over the year and 3% half on half.

BOQ has a strong balance sheet, with CET1 at 9.78%, well above APRA’s unquestionably strong benchmark and customer deposit growth of $2.3bn over the year.

We are well provisioned for the potential impacts to our portfolio as a result of COVID-19. Our updated economic assumptions are prudent and take into account the RBA forecasts and ongoing uncertainty. iven the Government’s stimulus and its good handling of COVID-19, there is potential upside opportunity should the economy recover at a faster rate

than currently forecast.

STRATEGY EXECUTION AND TRANSFORMATION

Managing Director and CEO George Frazis: 2020 has been a year like no other. Throughout these difficult times we have been working to support our customers, our people, and the broader economy. I am proud of how our people have responded, adapting quickly and working through more than 20,000 customer requests for assistance. During this period we have also substantially progressed our transformation, getting on with making BOQ a better bank.

Despite the challenging environment, BOQ has remained focused on strategy execution and transformation. Good progress has been made on the digital transformation with 6 core projects completed, including moving the data centres to a cloud environment. The first phase of the VMA digital bank remains on track for soft launch in December 2020.

We have a high calibre team of experienced leaders with strong execution skills, and we are seeing the results. The mortgage process has been simplified and reduced the time to yes from five days to one day, and we have seen our Net Promoter Scores increase across both the consumer and mortgage measures.

OUTLOOK

Managing Director and CEO George Frazis: While the potential impacts of COVID-19 remain uncertain, Australia is well positioned given the Government’s management of the health crisis and economic stimulus.

We remain focused on executing on our strategy and maintaining momentum in our business. We have a clear transformation roadmap and are delivering against it. Although difficult to predict in this environment, we expect to broadly deliver neutral jaws in FY21 driven by above system growth in lending, margin management to within 2-4bps decline, and cost growth of c.2%. Our prudent collective provision sees us well placed to withstand anticipated lifetime losses arising from COVID-19.

Our capital position is strong and organic capital generation will provide us with the ability to invest in and grow our business. We are committed to delivering long term shareholder value through sustainable, profitable growth and attractive returns. We understand the importance of dividends for our shareholders.

Investor briefing:

BOQ’s results webcast will be held:

Today at 11am AEDT.

The webcast address is:

https://edge.media-server.com/mmc/p/9voerrmf

Teleconference details are as follows:

Dial-in number (Australia):

02 8373 3507 or Toll Free 1800 175 864

Dial-in number (International): +612 8373 3507

Conference ID: 1790016