Open your Everyday Account

Why open an Everyday Account?

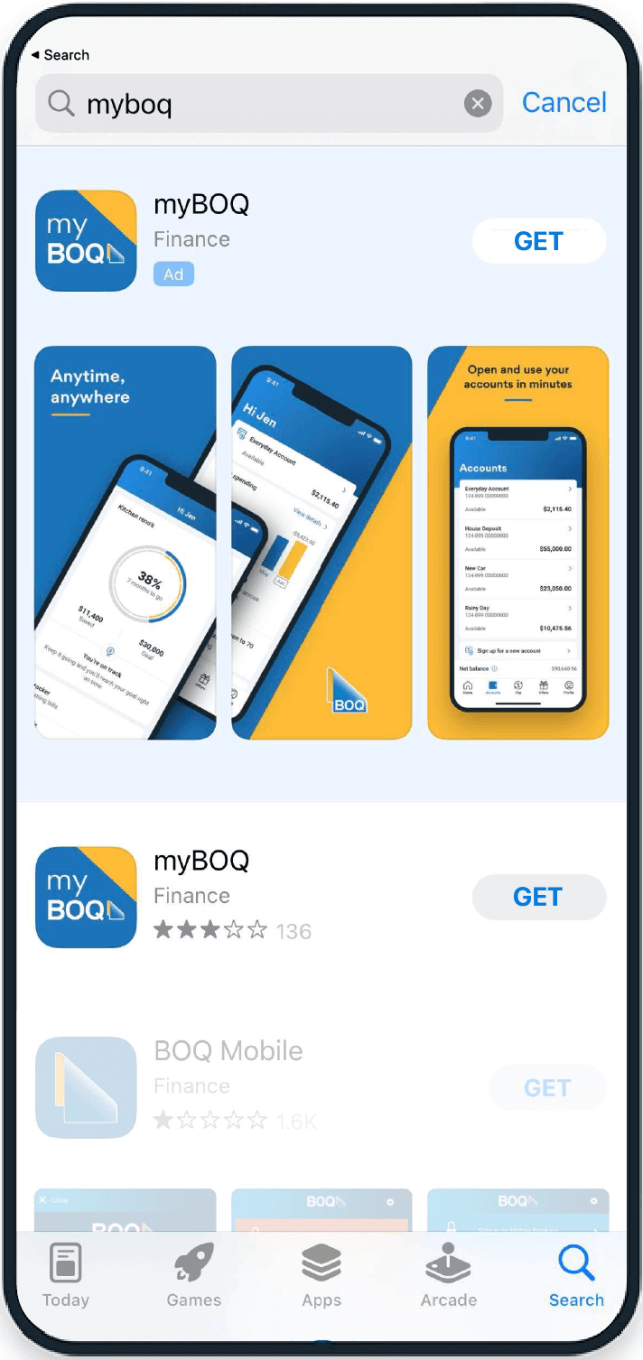

Our low fee transaction account available on the myBOQ app, that helps you spend smart with real-time payments, bill tracking and budgeting tools.

A transaction account to make everyday spending easy

Our Everyday Account comes with a BOQ Visa Debit Card for 'anywhere, anytime' shopping.

BOQ Visa Debit card features

Fees and Charges

Please view the myBOQ Deposit Account Interest Rates, Transaction Limits, Fees and Charges document for more details.

Ready for a new bank account? Start here.

Before you apply for the Everyday Account

You will need:

- to be aged over 14

- to be the account holder (applications cannot be completed and submitted by an Executor/Administrator/Power of Attorney/Legal representative)

- an Australian residential address

- an Australian driver's licence or Australian passport

- an Australian mobile number

- a smartphone that supports iOS 14.0+ or Android 9.0+.

More information

on card controls

myBOQ In-app Chat

Profile > Help & Support > Chat with us

For all general enquiries and matters relating to the myBOQ app.

Explore more savings and transaction accounts:

BONUS INTEREST VARIABLE RATE FOR BALANCES UP TO $50,000 IF BONUS INTEREST CRITERIA MET**

Future Saver Account

Our highest interest savings account for 14 to 35-year-olds. Meet the simple criteria to earn the bonus interest and watch your savings soar.

- Available on the myBOQ app

- No monthly account fees

- Comes linked with an Everyday Transaction Account

- Earn bonus interest each month when you meet the criteria**

BONUS INTEREST VARIABLE RATE FOR BALANCES UP TO $250,000 IF BONUS INTEREST CRITERIA MET**

Smart Saver Account

Our high interest savings account for customers 36 years or older.

- Available on the myBOQ app

- No monthly account fees

- Comes linked with an Everyday Transaction Account

- Earn bonus interest each month when you meet the bonus interest criteria**